2025 Private Lending Market Analysis: What Loan Data Reveals About Industry Shifts

Definitions and Methodology

Definitions

A bridge loan is any loan with a duration of 36 months or less utilizing interest-only payments for the duration of the term and containing a balloon payment at the end of the loan. Bridge loans are commonly referred to as residential transition loans (RTL), fix-and-flip, non-owner occupied, hard money, or in other terms that describe a short-term loan generally secured by a residential property for investment purposes.

DSCR loans are 30-year term loans secured by rental properties. DSCR stands for Debt Service Coverage Ratio, which identifies that the primary underwriting for these loans is done by dividing the monthly net operating income of the property by the monthly debt service.

A User refers to a unique company using the Lightning Docs platform. If multiple individuals within the same company access the platform, they are collectively counted as a single user.

Methodology

Loans below $50,000 and above $5,000,000 have been removed from the data set.

Loans with interest rates below 4% and above 20% have been removed from the data set.

For the loan volume slides, the user must have signed up with Lightning Docs prior to 2024

In 2025, we saw clear confirmation that private lending remains a resilient industry. Despite ongoing distractions and broader macroeconomic shifts, private lenders were able to grow volumes meaningfully compared to 2024. One of the clearest takeaways from the year is the continued shift toward DSCR lending, with long-term loans far outpacing bridge loans throughout 2025. While many lenders on the Lightning Docs platform continue to focus primarily on bridge loans, those actively producing DSCR loans are consistently posting significantly higher volumes.

In this end-of-year report, we’ll cover our usual metrics — interest rates, loan amounts, and geographic trends — while also taking a closer look at where new markets emerged in 2025 and where lenders may want to focus their attention in 2026. As always, we’ve prepared more insights than we can fit in one article. To receive our full data set, click on the button below.

Bridge Loans

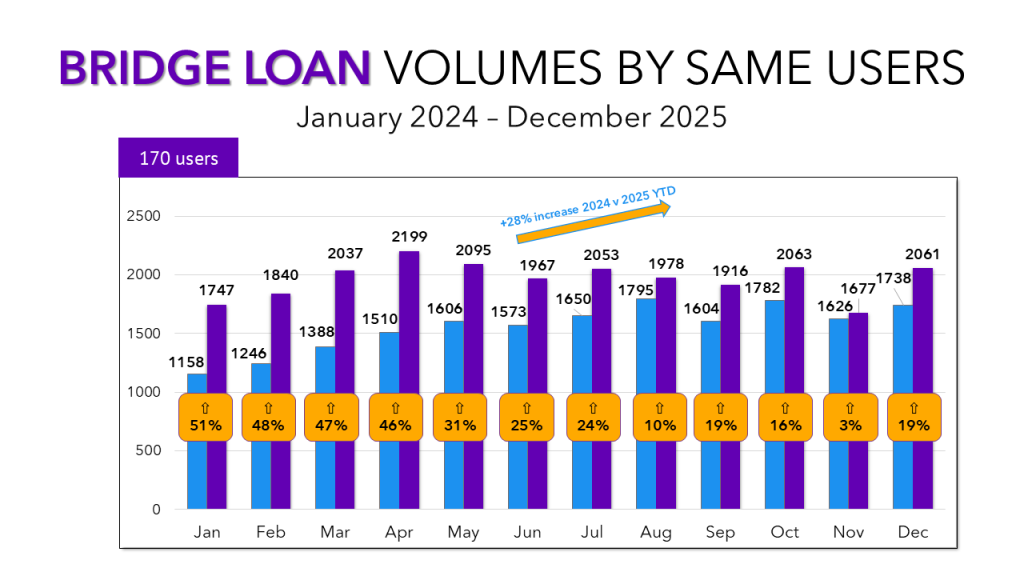

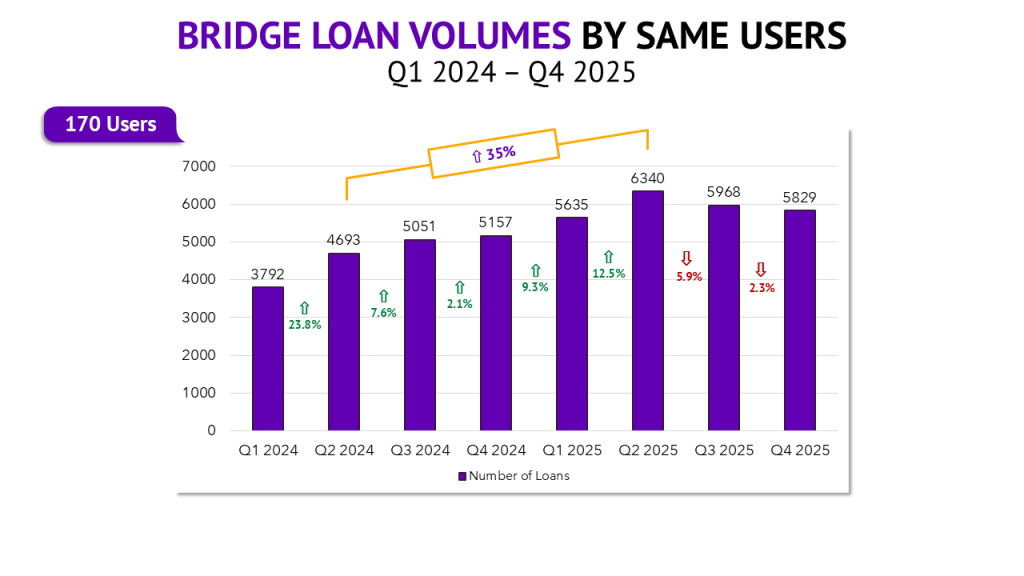

There are a few ways we can look at the status of bridge loans. On an annual level, bridge loan transactions were up 28% over 2024. In a vacuum that’s impressive growth, but when compared to previous years or this year’s DSCR performance, it pales in comparison. Then we could look at it on a quarterly basis. After an all-time high in Q2, we’ve seen two straight quarters of decreasing volume. While that seems like a pessimistic signal, a more granular view reveals a promising development. Following a very disappointing November with 1,677 total bridge loans, I voiced concern that similar performance in December could mean the first month of negative growth we’ve seen. Thankfully that didn’t happen. With 2,061 loans in December, Lightning Docs users produced the fourth highest total of 2025. The strong finish to 2025 could signal a return to the steadier growth pattern bridge lenders had become accustomed to in prior years.

Bridge Interest Rates

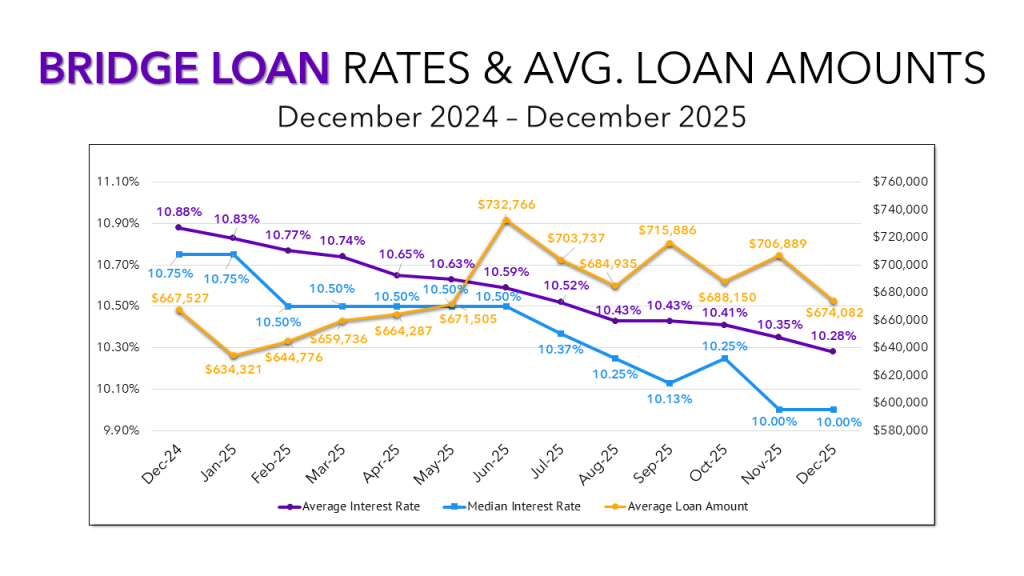

Average bridge loan interest rates continued their downward trend throughout 2025. At 10.28% in December, they finished the year 60 basis points lower than they entered the year with. This is a trend that actually dates back to January of 2024. Since then, nearly every month has seen a decrease in average interest rates. Average loan amounts have been up and down lately, but ultimately at just over $674,000 we ended the year roughly where we started it.

Top Bridge States

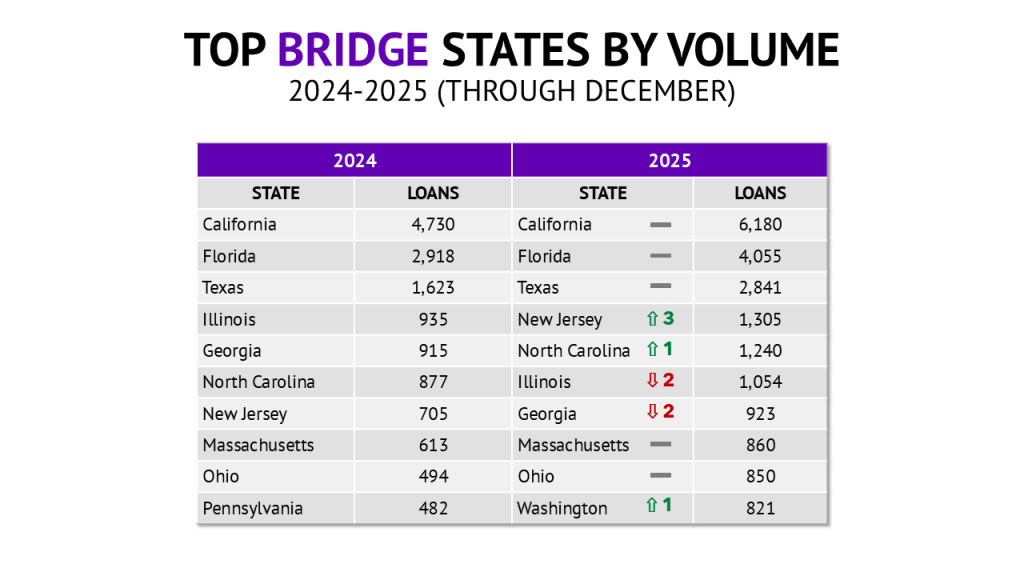

The top three states for bridge loans have remained consistent, with California, Florida, and Texas continuing to lead the way. New Jersey emerged as the largest mover among the large markets in 2025, rising to become the fourth-largest bridge loan market. Illinois and Georgia both slipped a few spots after showing relatively little year-over-year growth. Pennsylvania fell out of the top 10 entirely, while Washington moved in to take its place.

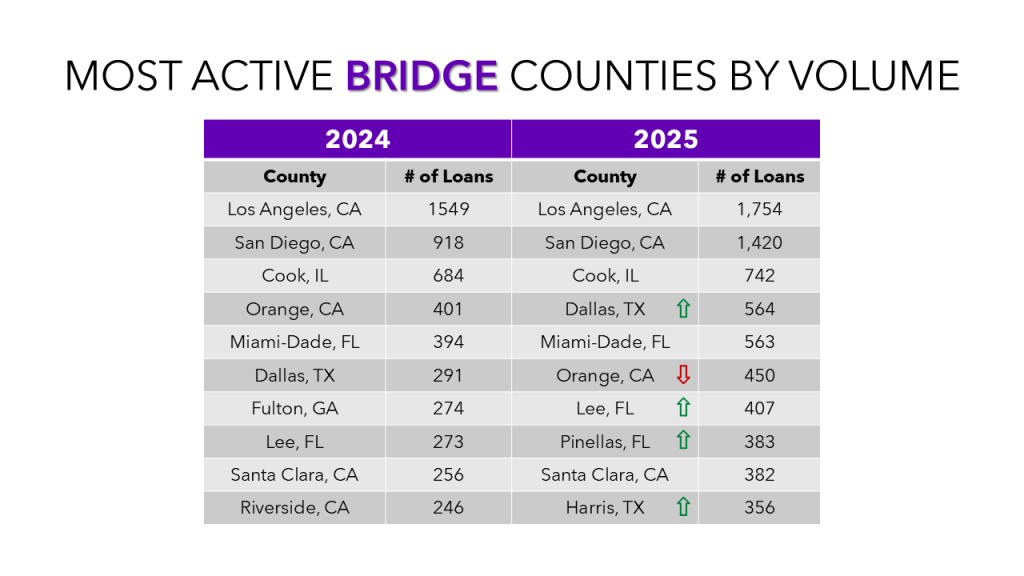

Top Bridge Counties

Los Angeles County maintained its position as the top bridge loan county. A huge year from San Diego, significantly closed the gap between the top two markets. The top three states dominated this list with Cook, IL being the only county not in CA, FL, or TX on the list.

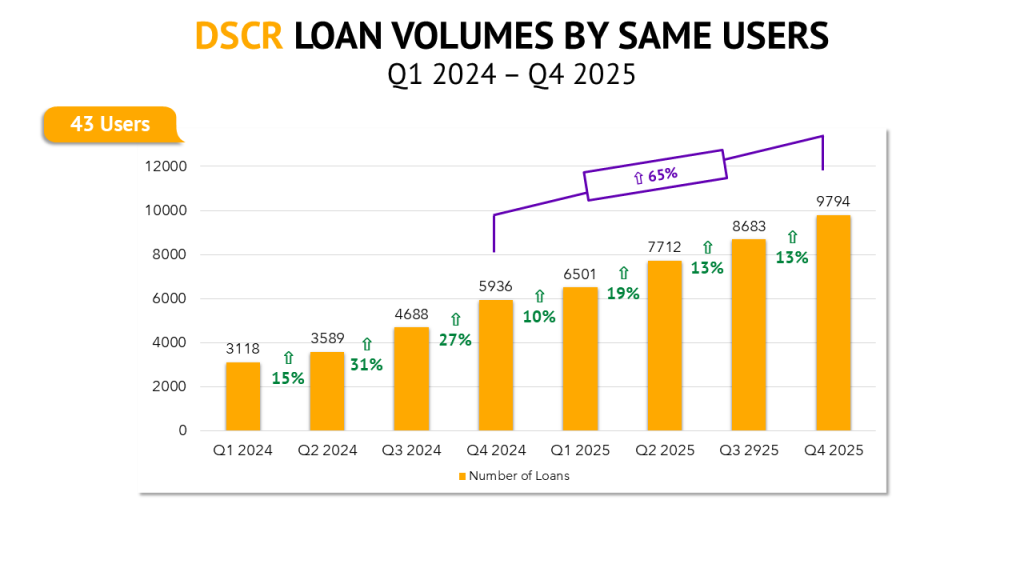

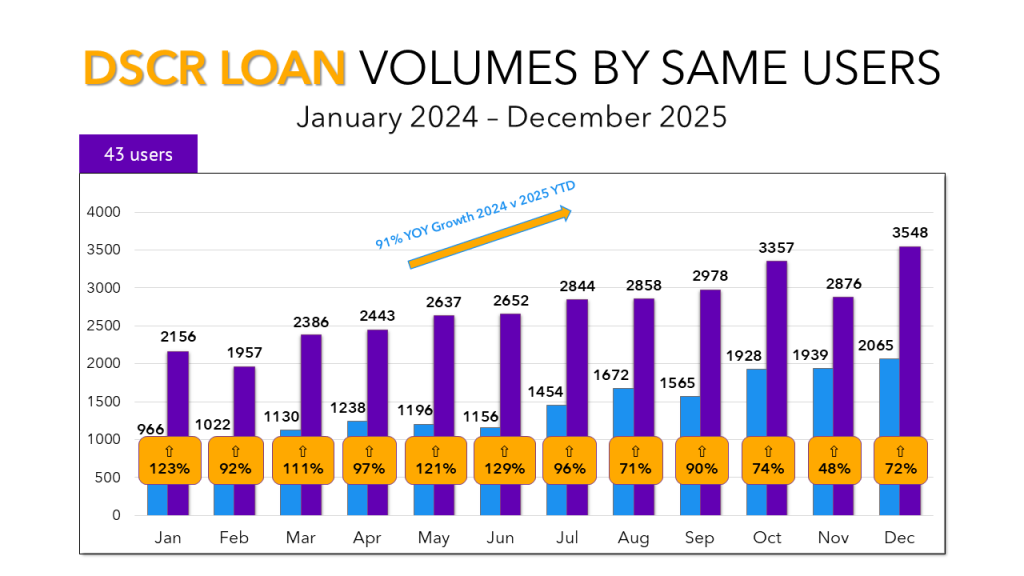

DSCR Loan Volumes

Unlike bridge loans, no matter which way you look at it, DSCR lending experienced tremendous growth in 2025. On an annual basis, DSCR lending was up 91% year-over-year among Lightning Docs users that have been on the platform since 2024. On a quarterly basis, loans are up at least 10% each quarter dating back to the start of 2024. And with 3,548 DSCR loans in December, we ended the year with a record-high month, the tenth record month in 2025.

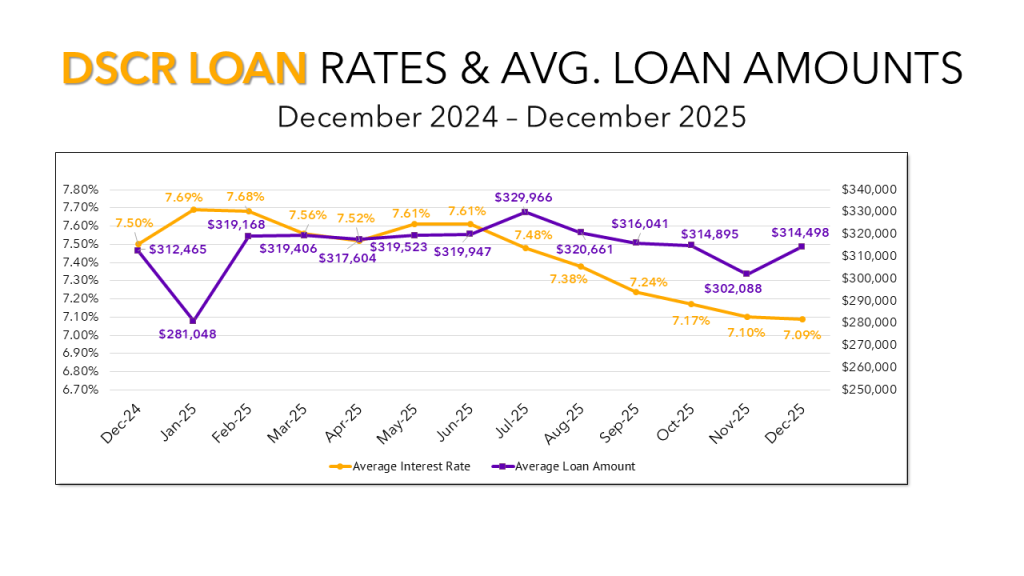

DSCR Average Interest Rates and Loan Amounts

Average DSCR interest rates also continued to trend downward throughout the year, finishing 60 basis points lower than where they began. If this trajectory holds, average rates could dip below 7% in 2026. DSCR loan amounts remained relatively stable, with most months falling in the $315,000 to $320,000 range. The year ended at $314,498, consistent with that pattern.

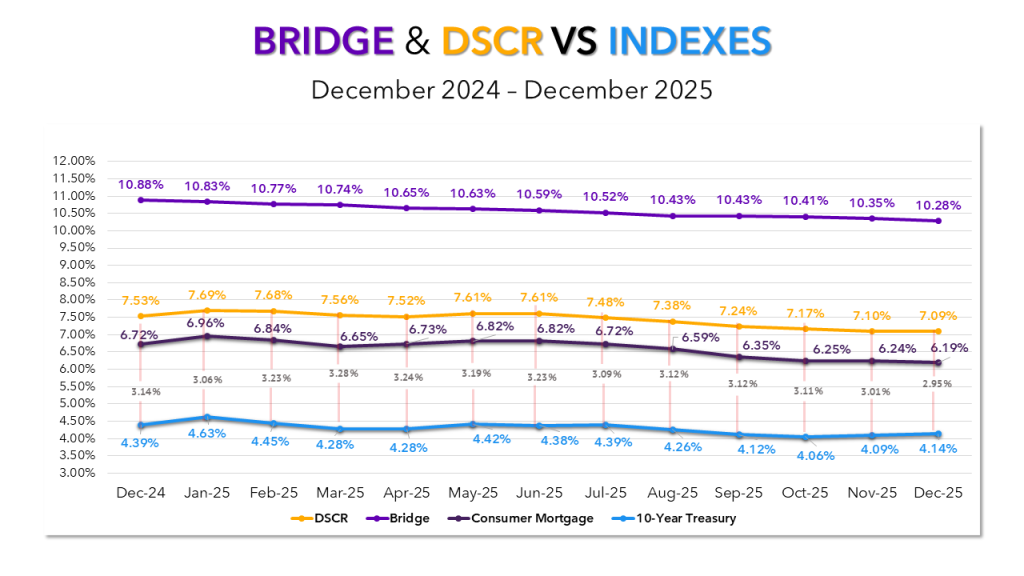

Bridge & DSCR vs Indexes

In addition to the private lending interest rates we track, consumer mortgage rates have also been trending downward. At 6.19% in December, they’re 77 basis points lower than where we started the year. The 10-Year Treasury, while 39 basis points lower than where it began 2025, has ticked upward over the past few months. An increase to 4.14% in December timed with another decrease in DSCR rates led to the smallest spread we’ve seen in over a year at 2.95%.

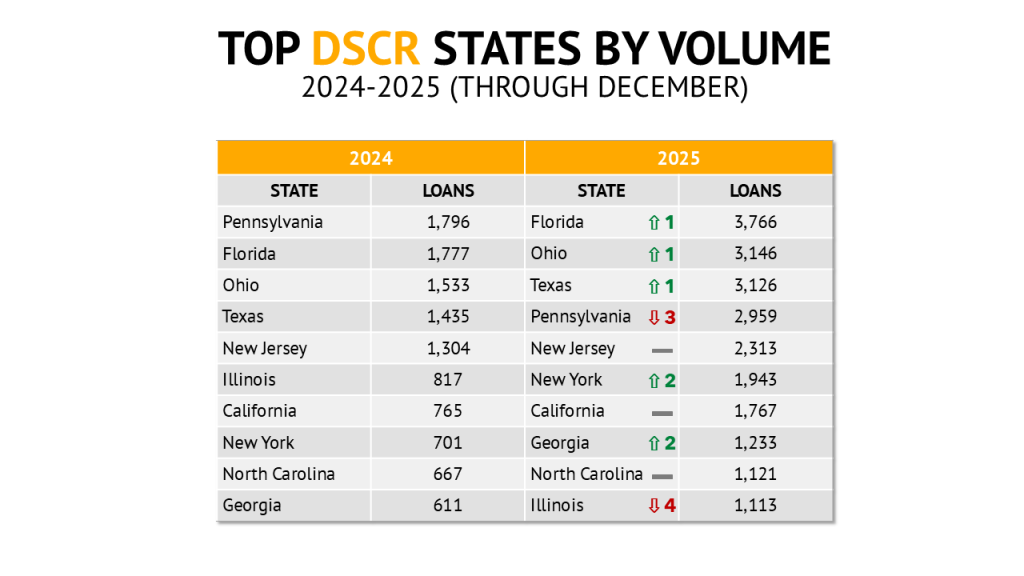

Top DSCR States

Florida ended the year as the top DSCR state by number of transactions, while Pennsylvania, the leading state in 2024, fell to fourth in 2025. Illinois also slipped four spots despite posting higher volume year over year. New York and Georgia each more than doubled DSCR production and climbed two positions in the rankings. Movement within the top states required meaningful growth, as every state increased DSCR loan volume by at least 25% in 2025.

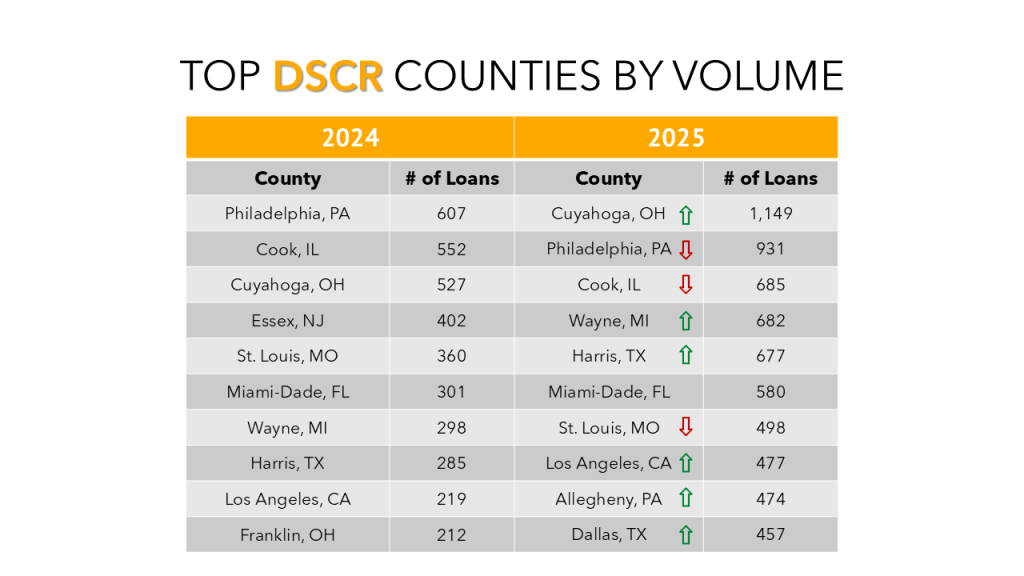

Top DSCR Counties

Cuyahoga, OH took over as the top DSCR county in 2025. Last year’s #1 market, Philadelphia, dropped just one spot to #2. Alleghany, PA and Dallas, TX are new to the top 10 taking over for Wayne, MI and Franklin, OH which both dropped out.

Biggest Movers

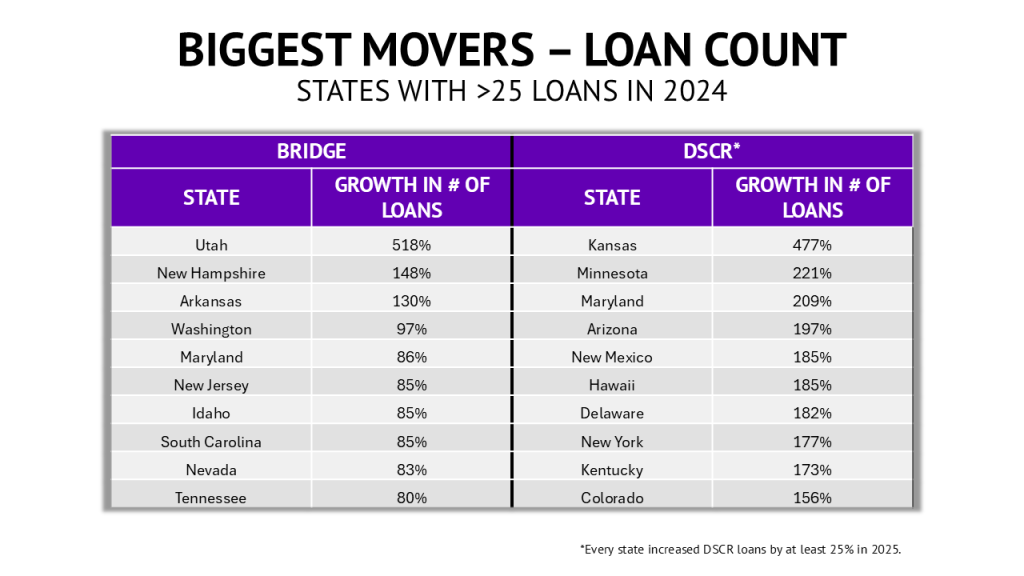

One of the most telling year-end metrics is where loan volume increased the fastest on a state-by-state basis. To focus on the most meaningful growth, we’ve eliminated states with fewer than 25 loans in 2024 from the dataset.

For bridge loans there’s a clear winner here. Utah increased its bridge loan volume by 518% in 2025. Utah finished 2024 as the 41st state in terms of bridge loan transactions and rose up to 26th in 2025. New Hampshire and Arkansas also showed over 100% YoY growth in a year where bridge lending overall fell short of expectations.

DSCR also had one state that stood out from the rest. Kansas increased the number of transactions by 477%, finishing as the 25th ranked state, up from 36th in 2024. With the surge of DSCR loans in 2025 it’s no surprise that many states showed incredible YoY growth. Each of the top 10 movers experienced over 150% growth.

Looking back at 2025, the data reinforces what many lenders experienced firsthand: private lending continues to adapt and grow, even in uncertain environments. While bridge lending showed signs of stabilization late in the year, DSCR lending clearly emerged as the primary growth engine, with expanding volumes, narrowing spreads, and increasing participation across every state. Geographic diversification also accelerated, with several non-traditional markets posting outsized year-over-year gains.

As we head into 2026, lenders may want to pay close attention to both product mix and market selection. DSCR momentum appears durable, while select bridge markets may be positioned for renewed growth. Together, these trends point to a private lending market that is still actively recalibrating rather than settling into a new equilibrium.