Definitions and Methodology

Definitions

A bridge loan is any loan with a duration of 36 months or less utilizing interest-only payments for the duration of the term and containing a balloon payment at the end of the loan. Bridge loans are commonly referred to as residential transition loans (RTL), fix-and-flip, non-owner occupied, hard money, or in other terms that describe a short-term loan generally secured by a residential property for investment purposes.

DSCR loans are 30-year term loans secured by rental properties. DSCR stands for Debt Service Coverage Ratio, which identifies that the primary underwriting for these loans is done by dividing the monthly net operating income of the property by the monthly debt service.

A User refers to a unique company using the Lightning Docs platform. If multiple individuals within the same company access the platform, they are collectively counted as a single user.

Methodology

Loans below $50,000 and above $5,000,000 have been removed from the data set.

Loans with interest rates below 4% and above 20% have been removed from the data set.

For the loan volume slides, the user must have signed up with Lightning Docs prior to 2024

Bridge lending showed a rebound in October after several months of declining volume, while DSCR loans set yet another record high on Lightning Docs. As new markets continue to emerge across the country, lenders are finding opportunities for growth in regions that were once off the radar.

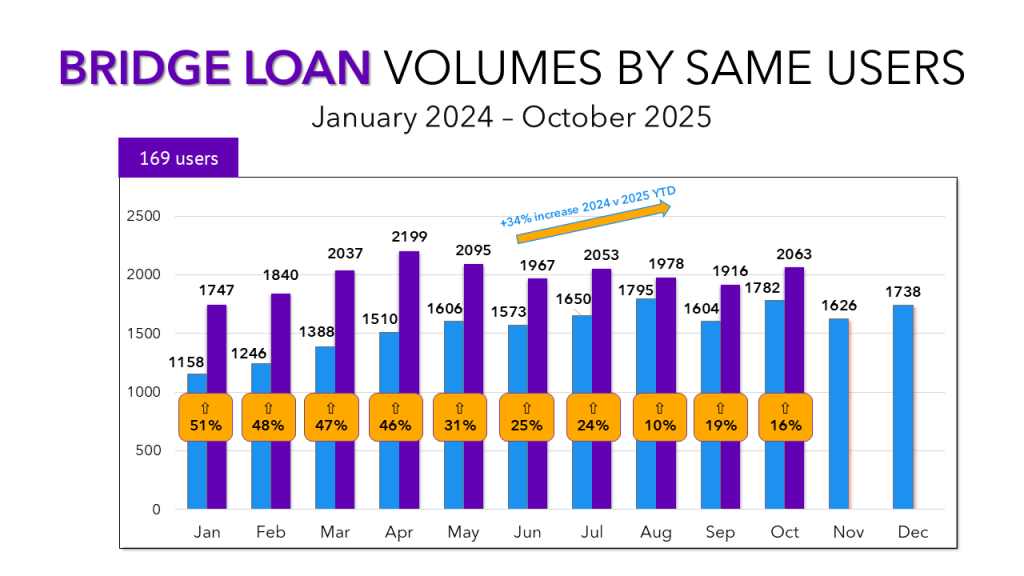

Bridge Lending Sees Its First Uptick Since July

Bridge loan transactions increased 6% month-over-month, marking the first gain since July. While volumes haven’t quite yet returned to the highs of the spring, this rebound signals a pause in the steady decline we’ve seen through the second half of the year.

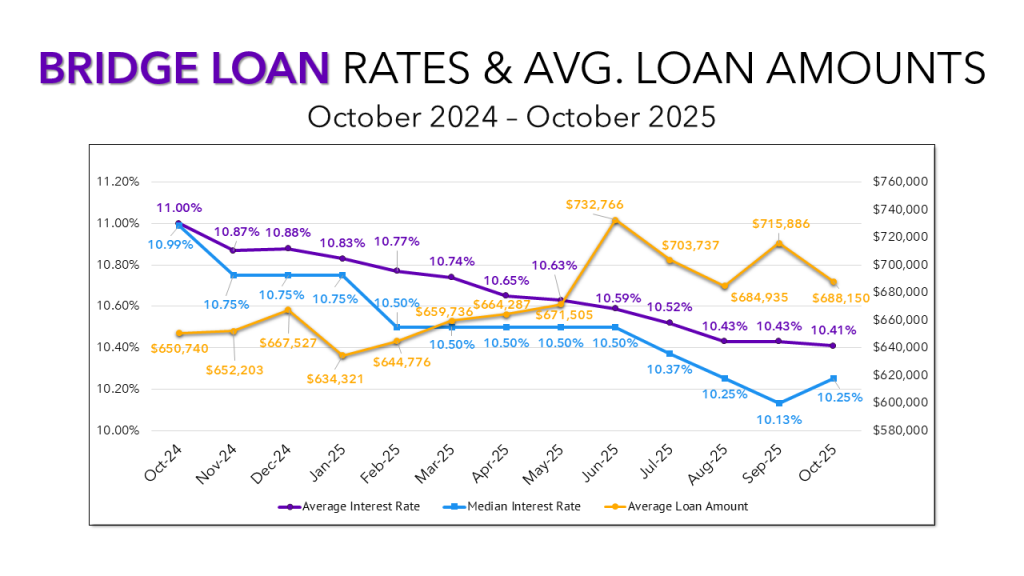

The reasons for the uptick in bridge loan transactions are not perfectly clear. There was an additional business day in October from September, and the year over year increases have remained steady between 10-20% for the past 3 months. Separately, average loan amounts decreased this month, down nearly $30k from September. Average interest rates also decreased on a national level to 10.41%. A slight anomaly this month was that median interest rates rose from 10.13% to 10.25%.

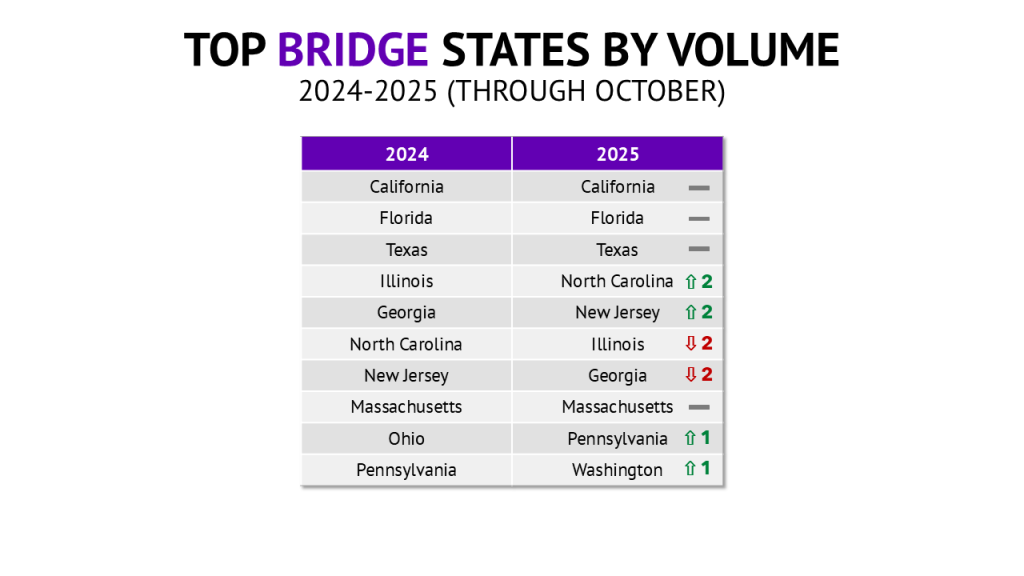

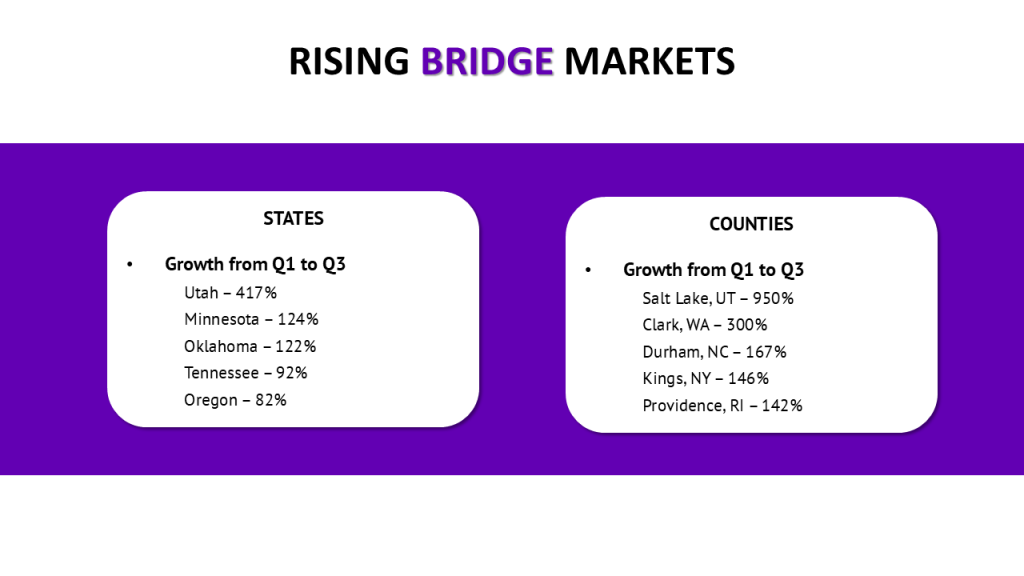

The top 10 most active states are shown below, but there hasn’t been much change from previous months. Instead, I’ve included data that highlights areas of growing opportunity. Utah has emerged as a hotspot for bridge lending, with both the state and its largest county, Salt Lake, showing the strongest growth from Q1 to Q3. Minnesota, Oklahoma, Tennessee, and Oregon round out the top five states for growth, demonstrating that lenders have opportunities in every corner of the country. The fastest-growing counties are similarly dispersed, with Clark, WA; Durham, NC; Kings, NY; and Providence, RI each seeing over 100% growth so far this year.

DSCR Lending Continues Its Surge

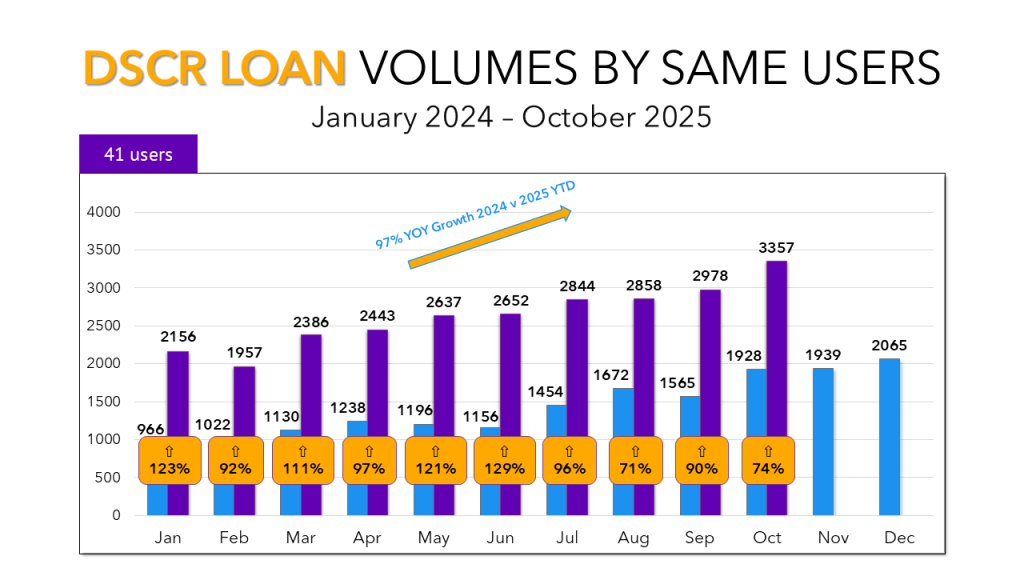

I’m tired of writing it, you’re tired of reading it, but the fact is DSCR transactions continue to surge. Lightning Docs users with us since the start of 2024 crossed the 3,000-loan threshold for the first time in October, reaching 3,357 total DSCR loans—an increase of 13% month-over-month, the largest jump since March. Lenders who’ve leaned into this segment continue to see strong results.

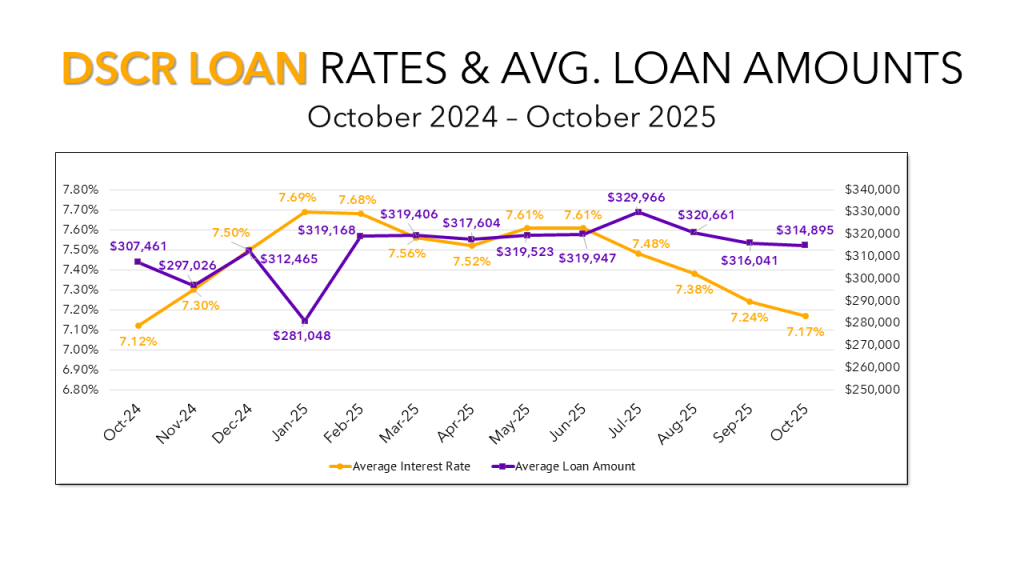

DSCR average loan amounts are around the same as last month at just under $315,000. Interest rates continued to decrease. At 7.17% they’re nearing the lowest we’ve seen since October 2024 which also explains why volumes have increased so much over the past few months. There is almost an equal distribution of loans with a 6.0-6.99% interest rate as there are 7.0-7.99% and if this trend continues we may in fact start seeing a significant loan volume under 6% for the first time since 2023 which will result in significant refinance opportunity.

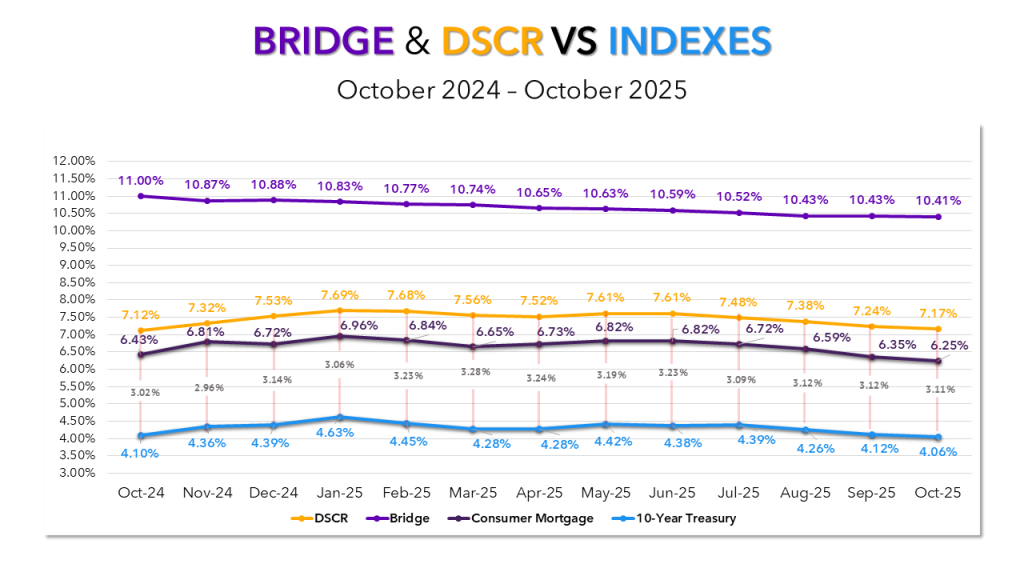

Rates Continue to Drop Across the Board

In October, the Federal Reserve lowered interest rates for the second consecutive month, and private lending rates followed suit. Both bridge and DSCR averages decreased, mirroring drops in key benchmark indices. Spreads between treasuries and DSCR rates continues to stay consistent showing that market appetite for the product remains robust.

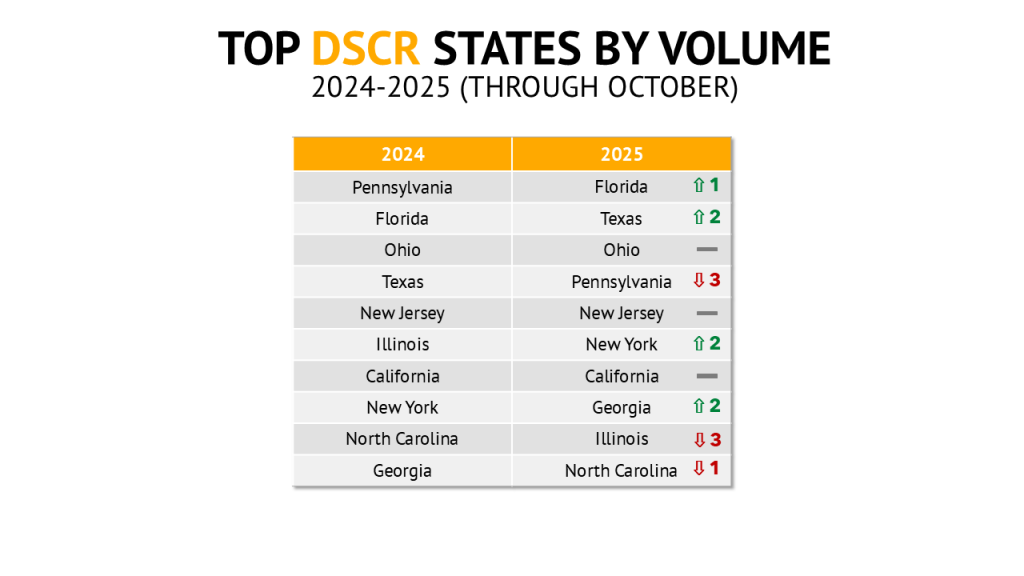

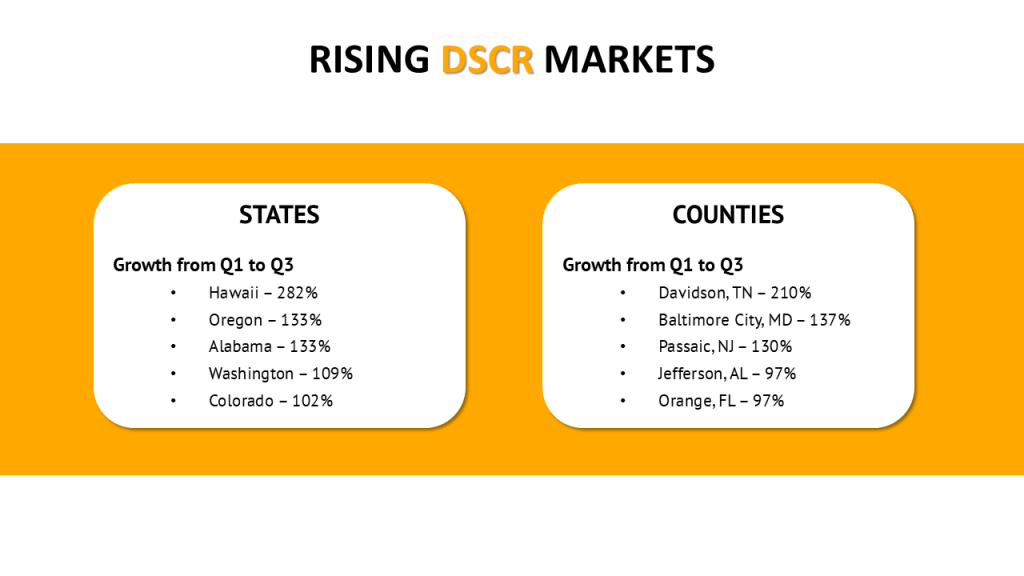

As with bridge loans, I’ve shared the top DSCR states below, but the real story is in the growing markets. Five states—Hawaii, Oregon, Alabama, Washington, and Colorado—have seen over 100% growth from Q1 to Q3, highlighting strong momentum in the western U.S. The counties, however, tell a different story. Davidson, TN; Baltimore City, MD; Passaic, NJ; Jefferson, AL; and Orange, FL are the five fastest-growing counties, all located in the Central and Eastern time zones.

Opportunities Nationwide

Even as overall loan volumes rise and established markets remain dominant, new regions are driving meaningful growth. From Hawaii to Alabama, lenders are expanding into untapped territories and finding new opportunities to scale their businesses.

As always, we’ve prepared additional insights from our data, including details on the top counties for bridge and DSCR lending, as well as where we’re seeing the highest loan amounts and interest rates. If you’d like a copy of that data, along with everything covered above, click the link below.