Definitions and Methodology

Definitions

A bridge loan is any loan with a duration of 36 months or less utilizing interest-only payments for the duration of the term and containing a balloon payment at the end of the loan. Bridge loans are commonly referred to as residential transition loans (RTL), fix-and-flip, non-owner occupied, hard money, or in other terms that describe a short-term loan generally secured by a residential property for investment purposes.

DSCR loans are 30-year term loans secured by rental properties. DSCR stands for Debt Service Coverage Ratio, which identifies that the primary underwriting for these loans is done by dividing the monthly net operating income of the property by the monthly debt service.

A User refers to a unique company using the Lightning Docs platform. If multiple individuals within the same company access the platform, they are collectively counted as a single user.

Methodology

Loans below $50,000 and above $5,000,000 have been removed from the data set.

Loans with interest rates below 4% and above 20% have been removed from the data set.

For the loan volume slides, the user must have signed up with Lightning Docs prior to 2024

Last month, the Fed cut interest rates for the first time in nine months. That coincided with some of the lowest rates we’ve seen for bridge, DSCR, and benchmark indices in nearly a year. September also brought another record month for DSCR loan transactions, even as bridge loan activity continued its gradual decline.

DSCR lending remains on a remarkable upward trajectory, but bridge loans have largely stagnated this year. I have a few theories for that. Many borrowers continue to voice concerns about housing affordability, and as you’ll see shortly, average bridge loan amounts have steadily increased throughout 2025. Fraud has also become a recurring topic in the industry, with rising cases causing more lenders to remain cautious. These factors may have slowed bridge loan growth this year, though the year-over-year figures are still strong.

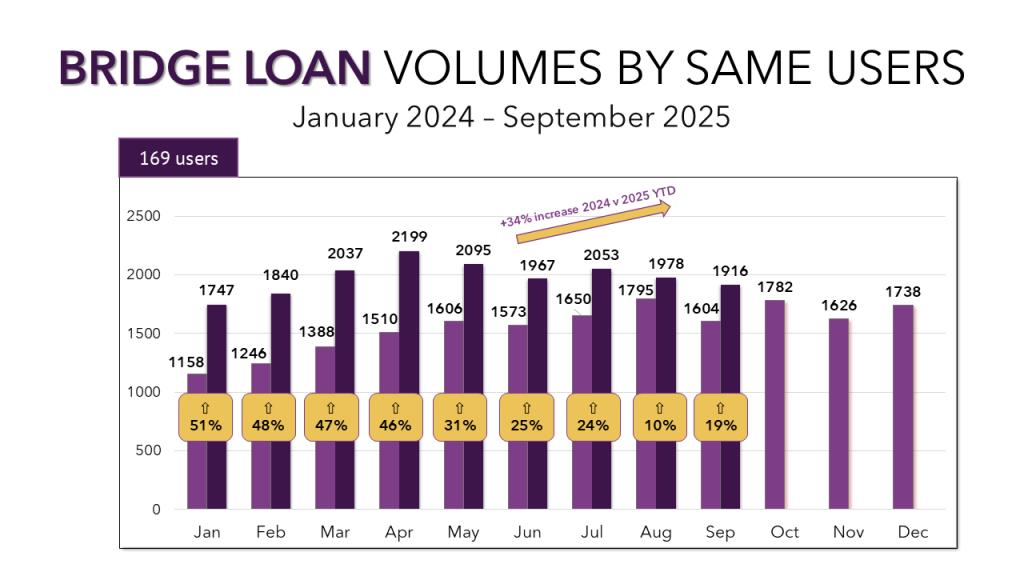

Bridge Loan Volumes

The 169 bridge loan users on Lightning Docs since the start of 2024 produced 1,916 loans in September. This marks a 19% increase in transactions from September 2024, but it’s also the lowest volume since February of this year.

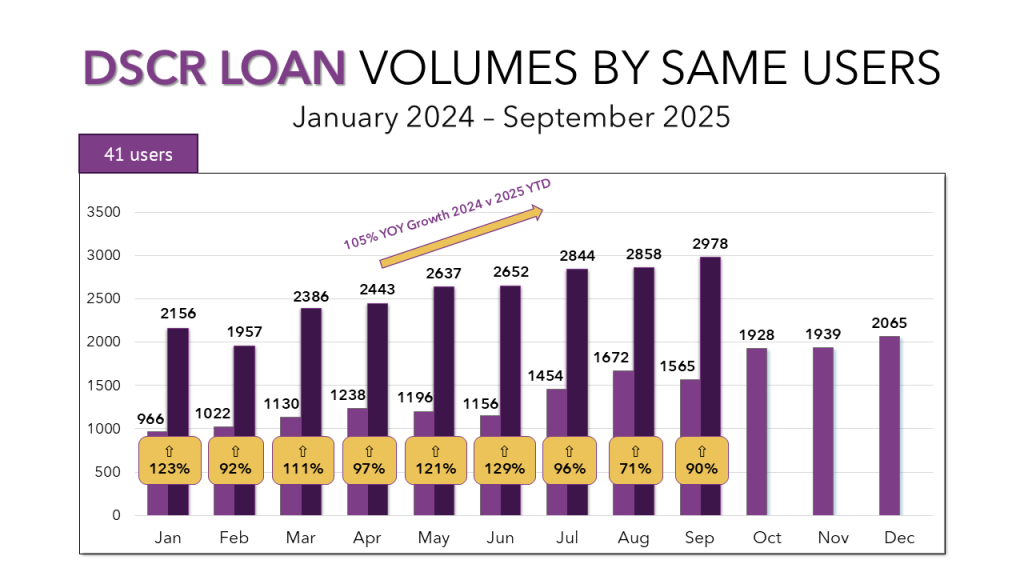

DSCR Loan Volumes

The 41 lenders using Lightning Docs for DSCR loans produced 2,978 loans in September. That’s 90% up from September of 2024, and once again a record high on the platform. I continue to be amazed by the growth in DSCR lending. This group of lenders, active since the start of 2024, now averages more than 72 DSCR transactions apiece each month. As the chart below shows, Q4 2024 had already shown strong momentum in this segment, and it will be interesting to see whether year-over-year growth maintains its current pace.

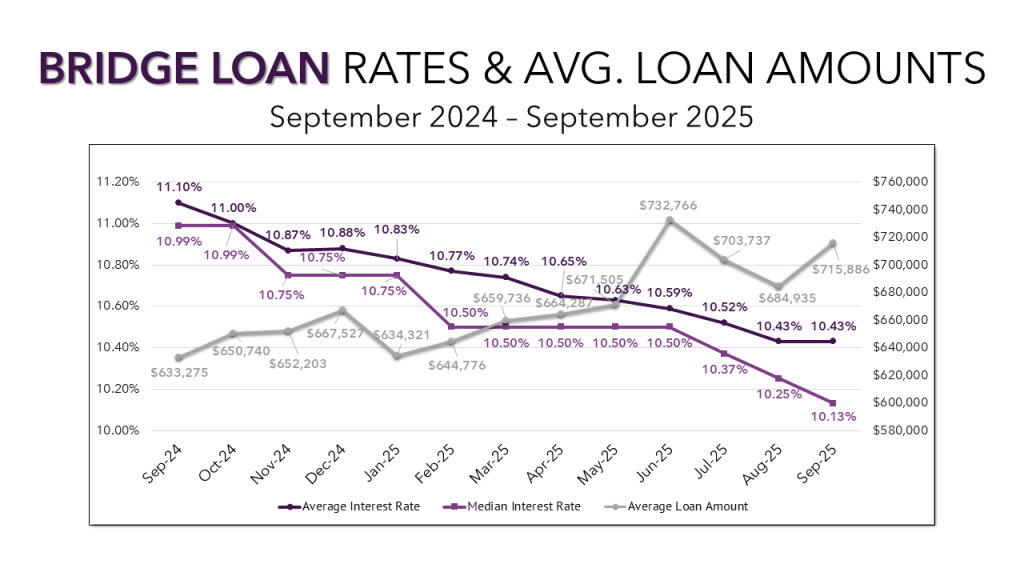

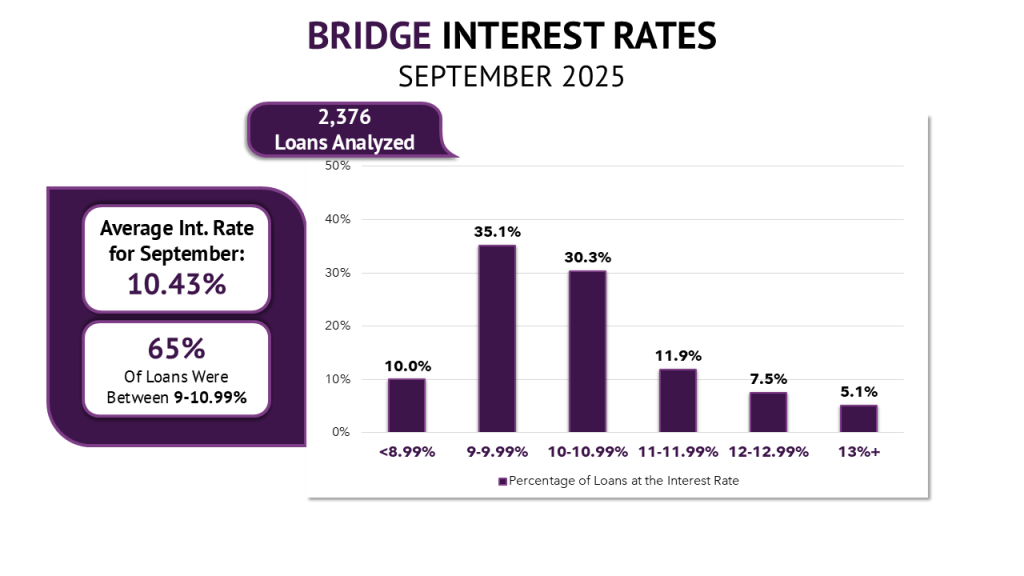

Bridge Loan Trends

September brought a notable rise in average bridge loan amounts, up $30,000 to just over $715,000. Average interest rates were unchanged at 10.43%, though median rates dipped to 10.13%. This is the first month of 2025 that hasn’t seen a decline in average rates, yet they remain at multi-year lows.

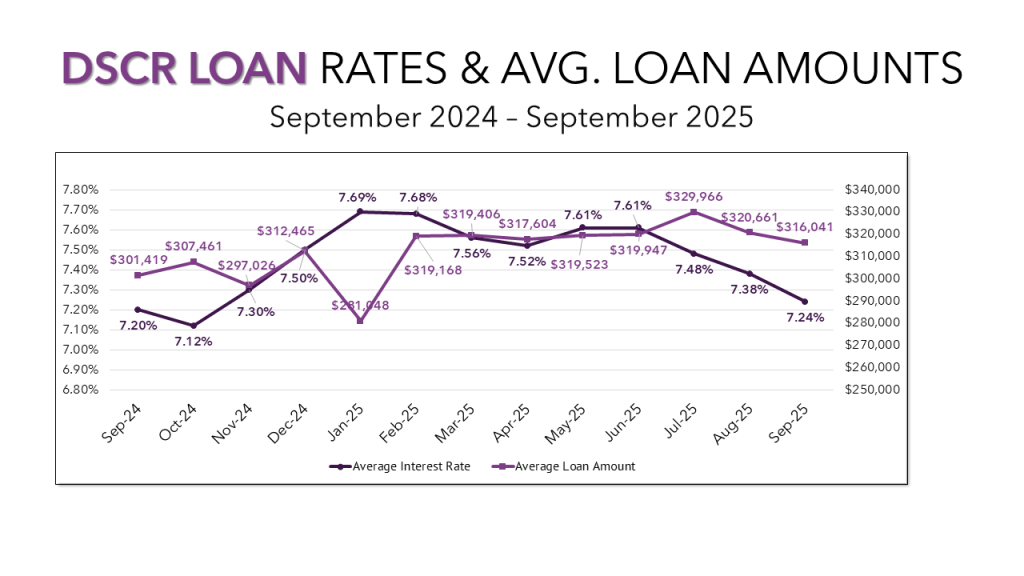

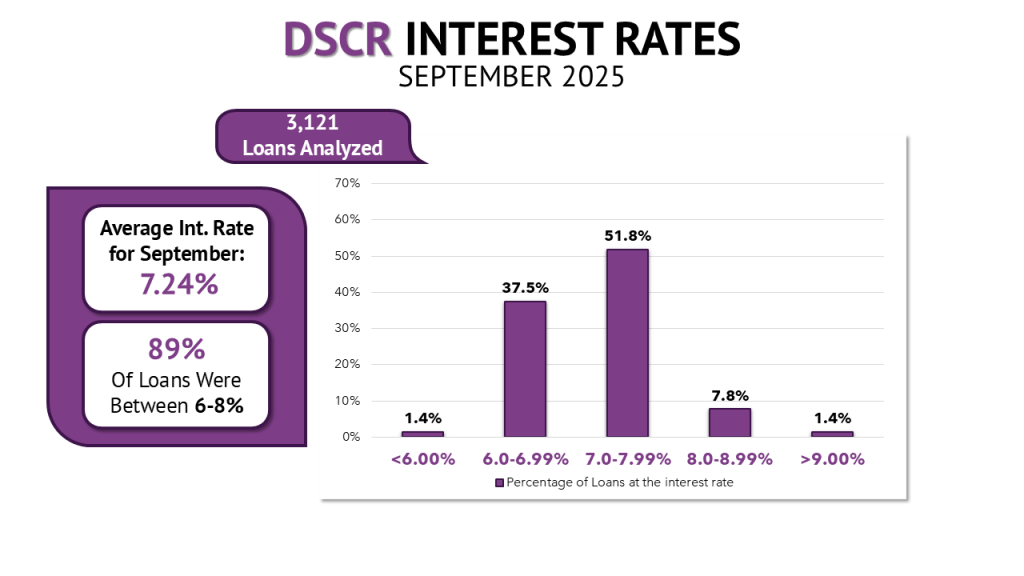

DSCR Loan Trends

Average interest rates for DSCR loans fell by 14 basis points in September, reaching 7.24%. Average loan amounts decreased slightly to $316,000. With rates continuing to slide, more than half of DSCR loans are now priced between 7% and 8%. Interestingly, a small sub-6% market appears to be emerging—with 46 loans in that range during September, exceeding the total from all prior months in 2025 combined.

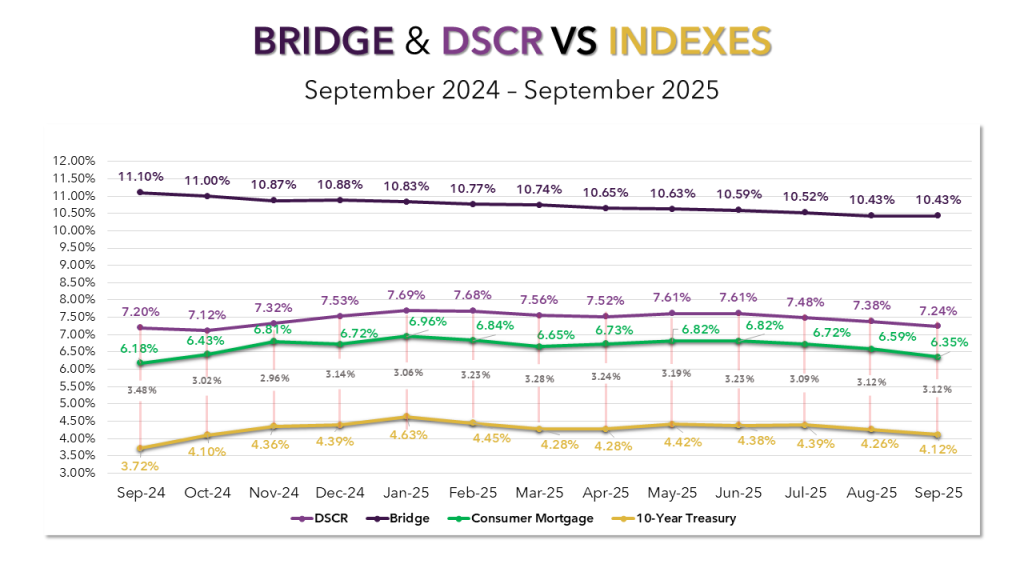

Bridge and DSCR vs Indexes

Across all benchmarks, September delivered the lowest rates in nearly a year. Bridge loans held steady at 10.43%, a multi-year low. DSCR rates dropped 14 basis points to 7.24%, their lowest since October 2024. The 10-year Treasury mirrored that 14 basis point drop, landing at 4.12%, and consumer mortgage rates fell 24 basis points to their lowest level since September 2024 resulting in an average conventional mortgage coming in at 6.35%. The spread between DSCR loans and the 10-year Treasury remains stable at 3.12%.